27+ option strangle calculator

To get the realtime OPC please sign up the the super buffet membership here See every outcome of a trade. Web A A A Covered strangle.

Calameo Around The World A Narrative Of A Voyage

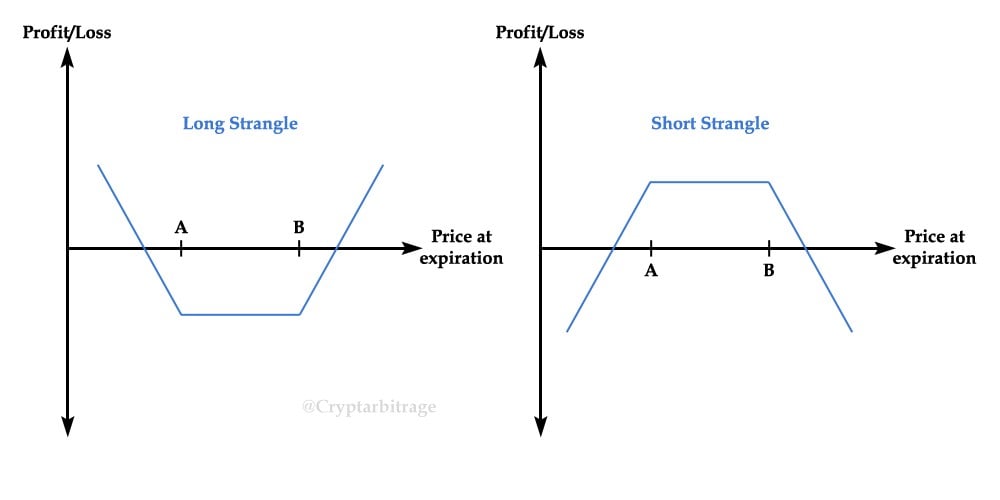

The strikes of the sold options are different you sell a Call with a higher strike and a Put.

. A short strangle options strategy is loved by traders looking to collect income. The setup involves selling a call and a put out of the money. Trading Calculators Option Strategy Builder Select Products Exchange Ticker Next.

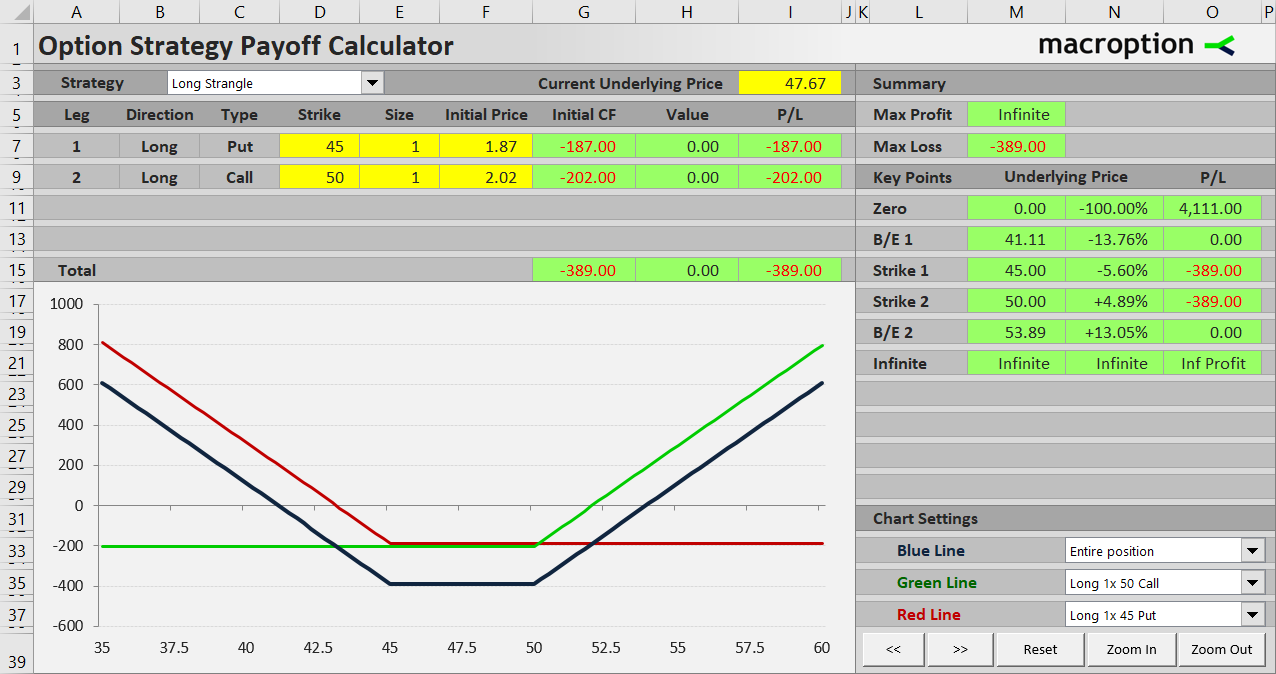

Enter the underlying asset price and risk free rate Step 3. Commissions from USD 015 to 065 per US option contract. Web Long Strangle Calculator Visualizer A long strangle is the inverse of a short strangle the setup involves buying a call and a put both out of the money.

Web Calculator Visualizer. The strategy generates a profit if the stock price. Put your money to work the markets are calling.

Directional Unlimited Profit Limited Loss A strangle. Web The option strangle strategy is a rather interesting strategy that will help us to take profits in two diametrical opposed scenarios allowing us to make money if the market moves or if. Web The option strategy builder allows you to construct different option and future products.

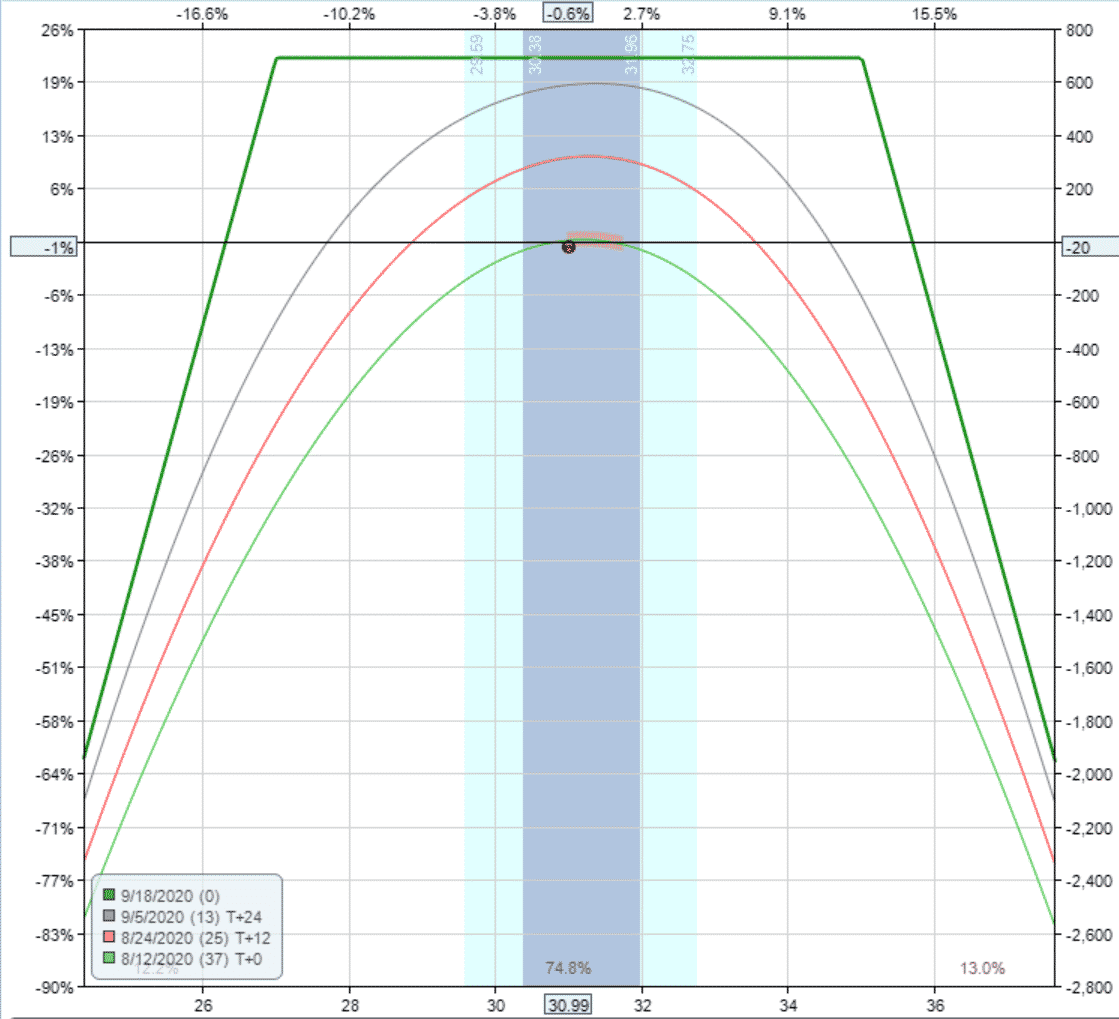

Invest in Options Stocks ETFs. Web Strangle Calculator Search a symbol to visualize the potential profit and loss for a strangle option strategy. The out of the money.

Enter the underlying asset price and risk free rate. What is a short strangle. Select your option strategy type Long Strangle or Short Strangle Step 2.

Long stock short OOM call short OOM put The Options Institute at CBOE Bullish Goal To earn leveraged income from modestly bullish price. Web The Short Strangle is an options strategy similar to the Short Straddle with one difference. Web A strangle involves using options to profit from predictions about whether or not a stocks price will change significantly.

Join 22m investors on Robinhood. Enter the maturity in days of the strategy. Ad Invest with Options Margin 247 Phone Support.

Web Option Strangle Calculator To see how an options contract may be profitable use the profit window under the analyze tab on ThinkorSwim or check out the. Ad Our tools and algorithms help investors design option strategies. Ad Real-time implied volatilities greeks scenario analytics and PL impacts.

The Long Straddle is an options strategy involving the purchase of a Call and a Put option with the same strike. Executing a strangle involves buying or. Web Covered Strangle Calculator A covered strangle traditionally involves buying stock selling and a call and put with the calls strike price higher than that of the puts.

Web Welcome to the worlds most powerful options profit calculator. Web Start Trial Short Strangle Calculator Search a symbol to visualize the potential profit and loss for a short strangle option strategy. Enter the maturity in days of the.

Select your option strategy type Long Straddle or Short Straddle Step 2. What is a strangle. Web A long strangle has a negative position delta and is a bearish options strategy while a short strangle is a bullish options strategy.

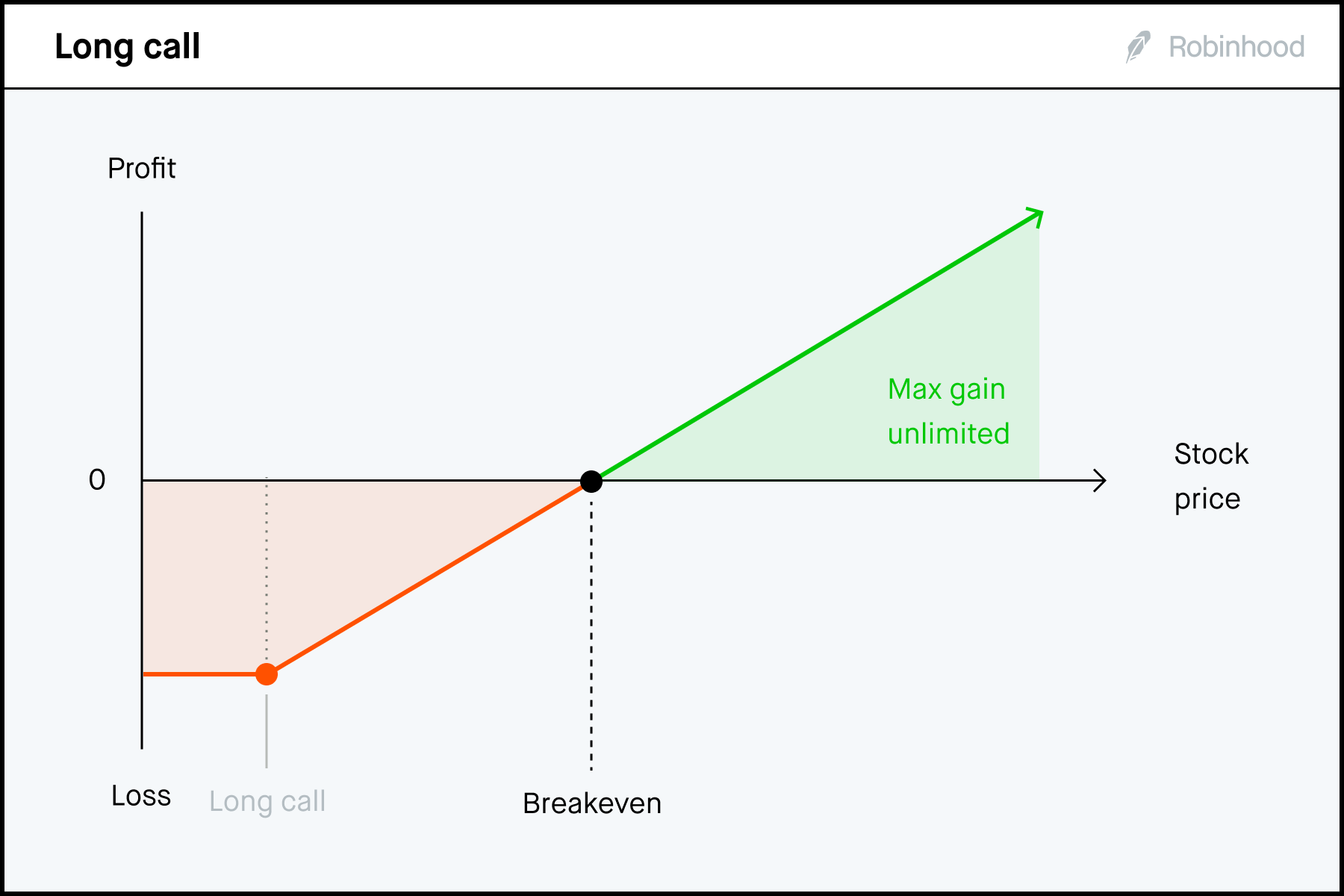

The P L Chart Robinhood

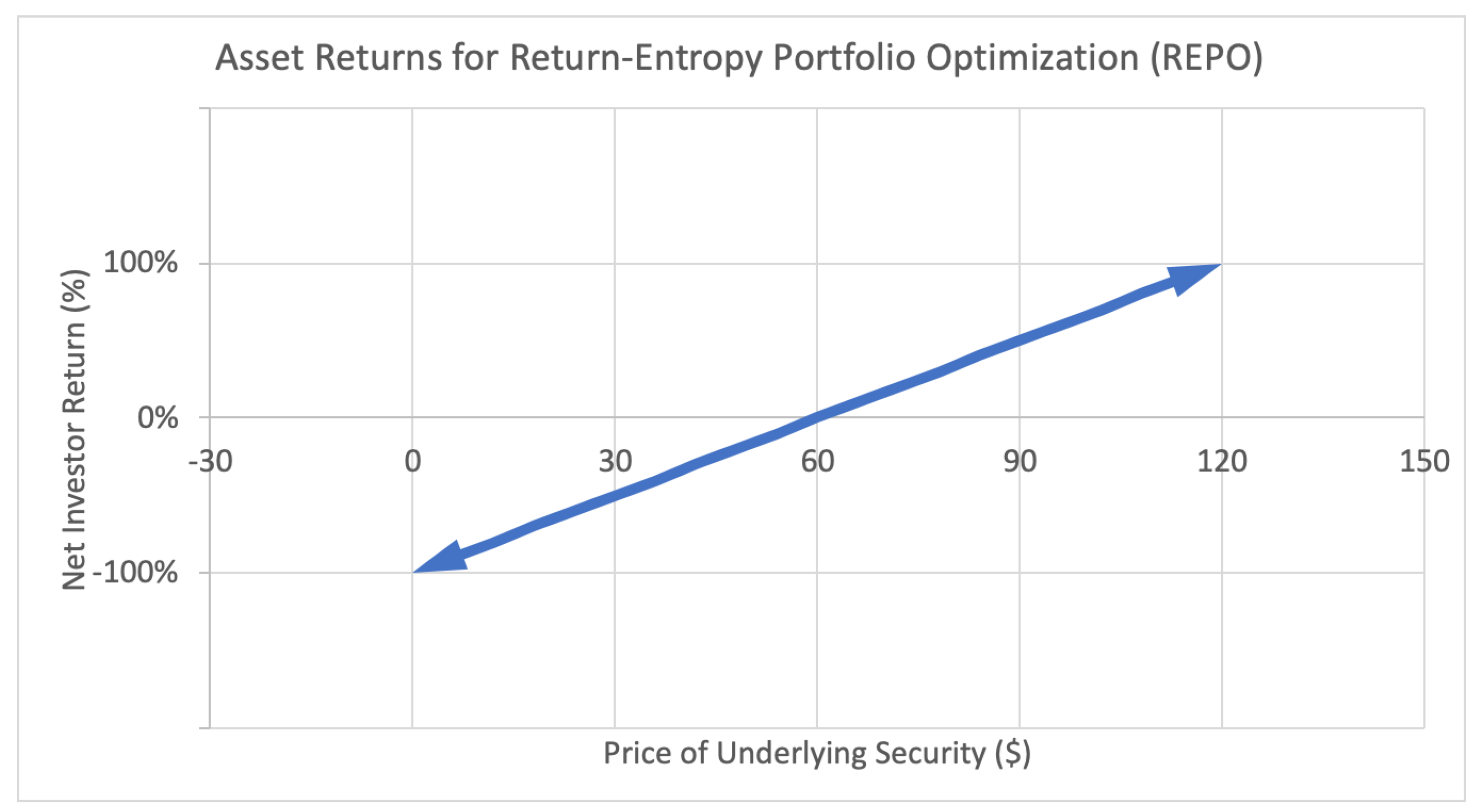

Entropy Free Full Text Option Portfolio Selection With Generalized Entropic Portfolio Optimization

Selling Options Outperformed In These 3 Vix Environments Spintwig

Multi Leg Options Positions Part 1 Straddles And Strangles Deribit Insights

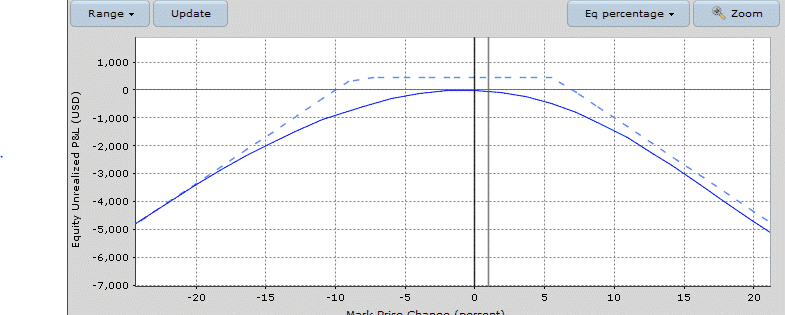

Re Visiting My Ng Trade R Options

Short Strangle Strategy Ultimate Guide For 2021

Basic Options Strategies Level 2 Robinhood

D Amp D House Rules Darkonnia

Re Visiting My Ng Trade R Options

Long Strangle Payoff Risk And Break Even Points Macroption

The Best Option Trading Calculator Excel Spreadsheet

How To Avoid Losses In Options Trading Finideas

Short Strangle Strategy Ultimate Guide For 2021

Re Visiting My Ng Trade R Options

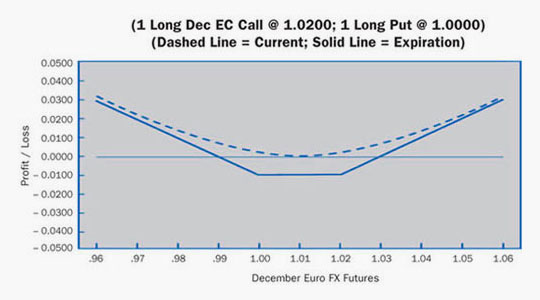

Long Strangle Stonex Financial Inc Daniels Trading Division

Amazon Com Mastering Option Short Strangles Trading Analysis Of Real Trades Included Ebook M Prady Kindle Store

Long Strangle Option Strangle Profit From Volatile Conditions The Options Manual